When you create a budget (essentially a list of your income and expenses), you’re making many decisions about your money in advance.

Because of this, it’s paramount to be realistic with the numbers you enter into it—most individuals overestimate their income and expenses, making budgeting inaccurate and counterproductive.

While it’s easy to say everyone should construct a budget, what do you do if you don’t have one? How about when your job changes or something unexpected comes up? Many financial experts and personal finance gurus agree that budgeting is critical to controlling your money.

If there are still some rough patches in your finances—or if you’re trying to dig yourself out of debt—it may take some time to get everything straightened out on paper. In the meantime, plenty of apps can make maintaining a budget simpler than ever before.

There are tons of personal finance books and blogs out there that can give you the nitty gritty details about budgeting, but here’s a quick rundown of what you need to know:

- Determine your income and expenses. While everything is coming out of your checking account, having a clear picture of where your money is being spent will help you make intelligent decisions in the future.

- List your expenses, from the small stuff (coffee) to the big stuff (mortgage). If you have something, you need help with categorizing, Google it! There are plenty of how-to guides for categorizing every kind of expense imaginable.

- Track your spending over two weeks or so. This is good practice for tracking next month’s spending as well. Note down how much you spend on each category each day.

- After two weeks, review your spending patterns and create categories for things that fall into the same general type (i.e., if most of your eating out is at breakfast joints, combine those expenses into one “Eating Out” category).

- Assign values to each category. Please do this by multiplying the total amount spent on each type by its percentage total of your overall spending.

The ideal answer for anyone seeking to gain financial control and accomplish their financial objectives. These apps streamline handling your finances and keeping checks on your spending thanks to various robust features and user-friendly interfaces.

Financial experts recommend top Budgeting and Money Management Apps because they give users a clear and comprehensive outline of their finances, enabling them to follow their spending, find places to save money, and develop realistic budgets.

These apps also provide solid tools for goal-setting and financial planning, empowering users to make wise financial decisions and advance their long-term financial objectives.

Financial organizations also advise consumers to use the Best Budgeting and Money Management Apps since they offer a timely, risk-free solution to handle their money. These apps deliver tools that simplify handling your money, such as automatic transaction categorization, notifications for suspicious activity, and the possibility to set up recurring bill payments and savings plans.

Below are the 8 Best Budgeting and Money Management Apps for iPhone

| App Name | Price | Bank Sync | Security | Why We Recommend | Features | Pros | Cons | Number of Ratings |

|---|---|---|---|---|---|---|---|---|

| Mint | Free | Yes | 256-bit encryption, Touch ID, Face ID | All-in-one budgeting, credit score monitoring, alerts for unusual spending | Budget tracking, bill payments, investment tracking, credit score monitoring, alerts for unusual spending | Easy to use, wide range of features, automatic categorization of transactions | Frequent syncing issues, in-app ads, customer support can be slow | 4.8 (1.5M+ ratings) |

| PocketGuard | Free | Yes | 256-bit encryption, Touch ID, Face ID | Easy-to-use interface, expense tracking, budget management | Expense tracking, budget management, customizable categories, in-app reporting | Simple and intuitive interface, customizable categories, no ads | Limited features compared to other budgeting apps, no investment tracking | 4.7 (400K+ ratings) |

| YNAB | Free trial, then $11.99/month or $84/year | Yes | Bank-level security | Helps you stop living paycheck to paycheck, reduces financial stress | Goal-setting, customizable categories, bank syncing, detailed reports, access to online community | User-friendly interface, helpful educational resources, proactive support team | Expensive compared to other budgeting apps, may not be suitable for those who prefer a hands-off approach to budgeting | 4.9 (20K+ ratings) |

| Expense & Budget Planner | Free | No | PIN protection | Simple budget tracking, expense management, bill reminders | Budget tracking, expense management, bill reminders, customizable categories | Easy to use, simple interface, no ads | No bank syncing, limited features compared to other budgeting apps | 4.6 (1.6K+ ratings) |

| Goodbudget | Free, with optional $6/month or $50/year upgrade for additional features | No | Bank-level security, passcode protection | Envelope budgeting system, customizable categories, expense tracking | Envelope budgeting system, customizable categories, expense tracking, syncing across devices | Great for those who prefer the envelope budgeting system, easy to use | Limited features with the free version, no bank syncing | 4.7 (27K+ ratings) |

| EveryDollar | Free, with optional $129.99/year upgrade for additional features | Yes | 128-bit encryption | Helps you plan your budget down to the last dollar, encourages saving | Budget tracking, bill payments, goal-setting, debt payoff planning, access to financial coaches | Easy to use, good for those who want to plan their budget down to the last dollar | Expensive for the paid version, limited features with the free version | 4.7 (7K+ ratings) |

| Personal Capital | Free | Yes | 256-bit encryption, Touch ID, Face ID | Wealth management and budget tracking in one app, investment tracking | Wealth management, investment tracking, retirement planning, net worth calculator, spending tracking | Great for those who want to track their wealth and investments, easy to use | Limited budgeting features, some users may find it overwhelming | 4.7 (47K+ ratings) |

| Honeydue | Free with Premium options | Yes | 256-bit encryption and TouchID/FaceID | Ideal for couples managing finances together | Shared budgeting, bill tracking, and account syncing | Only supports two users per account, some users have reported issues with syncing | 4.8 (25,000+ ratings) | |

| Fudget | Free with Premium options | No | Passcode and TouchID/FaceID | Perfect for those who want to manually track expenses without linking accounts | Simple and straightforward interface, ability to create and organize multiple budgets, no ads | No account syncing, limited customization options, lack of categories and subcategories | 4.7 (10,000+ ratings) |

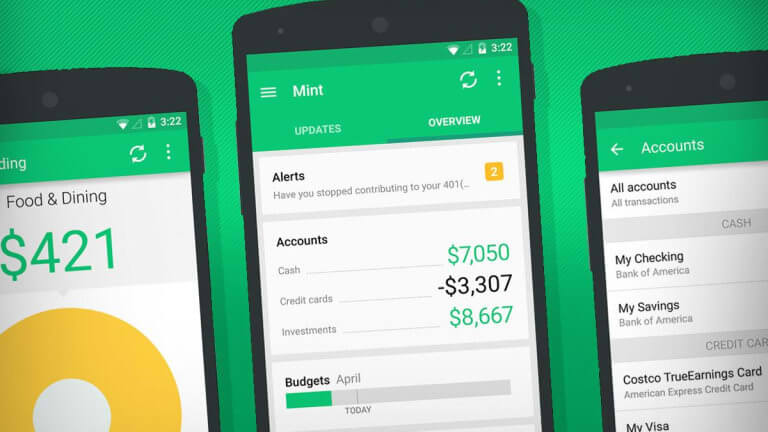

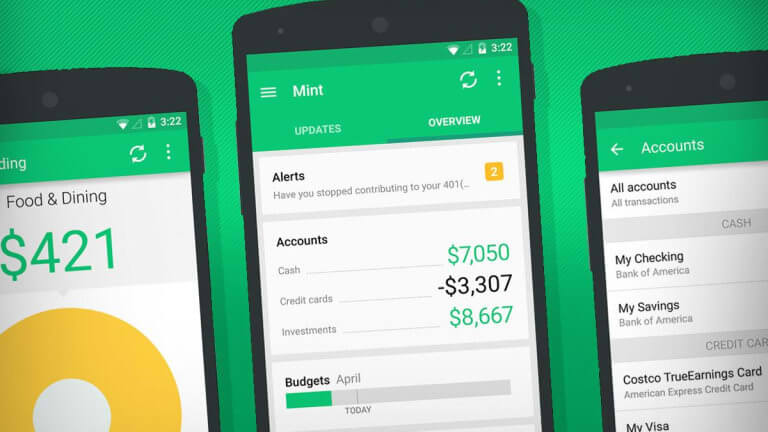

1. Mint

Budgeting can be a challenge for many people, especially those who are new to it. There are plenty of financial apps for iPhone that can help you organize your resources and keep track of how much money is coming in and going out, but the best budget app for iPhone is Mint.

Mint is a free app that’s easy to use and designed with the layperson in mind. It allows you to link all your financial accounts from different institutions—bank accounts, credit cards, loans, etc.—so you can track your spending on everything all in one place.

>> Best GPS navigation apps for iPhone

Forbes recommends Mint as the best budget app for managing finances, citing its comprehensive account syncing and budget tracking features.

The app sends you periodic alerts if you’re approaching a budget boundary or if there are any unusual transactions, which is great for those who need reminders like that. You can also set budgets for different categories so you know exactly how much money you have available to spend every month on certain things and whether or not you need to make adjustments (like cut back on dining out next month).

Mint also allows users to set goals based on their budget and helps them reach those goals by giving them reminders about savings goals or spending targets. Saving money for the long-term is easier when you’re reminded of it every day!

2. PocketGuard, for a simplified budgeting snapshot

Budgeting has long been a time-consuming and laborious activity, but one of the many great things about technology is that it’s made it easier for everyone to keep tabs on their money. Sure, there are plenty of budgeting apps out there, but if you’re looking for a simpler way to budget on the go, check out PocketGuard: an app that makes creating and tracking monthly budgets as simple as can be.

The app’s interface is divided into two main parts: your current budgeted balances and your list of upcoming transactions. The first thing you do is enter the amount you have left in each category, along with a custom category name if you’d like to track something specific (for example, I have a “Holiday gifts” category since I do most of my shopping online).

>> Best free iPhone tracking apps – Paid /Free

NerdWallet recommends PocketGuard as a budget app with a focus on helping users avoid overspending, thanks to its real-time tracking of expenses and ability to set spending limits.

You can also toggle whether or not to include your balance transfers in this total. Once you’ve added all your categories and their balances, tap the “Done” button at the top right. This will take you to your upcoming transactions list, where you can record what’s coming up in the next month by tapping an empty slot and filling in how much money you’ll be spending or receiving and in which category.

3. YNAB, Expense & Budget Planner

The YNAB app is a great choice for the budgeting newbie or someone who wants to get an overview of their expenses, but it’s also a great tool for someone who’s been doing budgeting for years. I’ll be honest—I’m not a fan of most budgeting apps.

They can be confusing and the tracking is usually too tedious. YNAB, on the other hand, has a simple interface so it’s quick to enter transactions and they provide helpful graphs, charts and reports that make understanding where your money is going fun.

I also love that they have classes online to help you understand how to use their platform (and thus budgeting in general) effectively.

The Balance suggests YNAB (You Need A Budget) as the best budget app for those looking to actively manage their spending and save money, noting its emphasis on budgeting and goal-setting.

If you’re not familiar with YNAB, it’s an app that helps you view your budget in a very visual way. For example, it might show a “budgeted for groceries” value of $300 over the course of three months. If you have $300 in your account, that means you have $0 to spend on groceries.

The app helps to visualize this idea by showing a red circle on the graph that expands the further you get into a given month (as if there’s a physical budget “spending container” that is filling up). You can use the app to set up budgets for categories like groceries, entertainment, etc. It will break down how much you can spend in each category per day or week. It also has features like autofilling your transactions as they happen based on actual expenses from previous months so it’s easy to keep track.

The app is so easy to use: you just log in and you can see all of your savings and spending accounts, everything is broken down into categories so you can see exactly where your money is going. It also has these great features like “Give Every Dollar A Job” which means assigning every dollar in your account a specific purpose like rent or food or gas or entertainment. This makes budgeting way easier because instead of having thousands of dollars in one big account, they’re all divided up into smaller chunks that are much easier to manage.

4. Goodbudget, Budget Planner

Goodbudget is a helpful, easy to use personal finance app that can help you manage your debt, budgeting, money management, and cash flow. The app helps you track all of your income and expenses so that you know where your money is going and how much you have to spend.

Goodbudget is a personal finance app with a nimble and powerful set of tools for budget planning, debt tracking, and money management. It’s perfect for people who have been trying to use spreadsheets to keep track of their finances, but find it difficult to stay on top of balance sheets when you’re moving money between accounts on a regular basis. With Goodbudget, you can make a budget quickly by adding accounts one at a time or importing them from your bank.

Money suggests Goodbudget as a budget app for those looking to stick to a cash-based budget, noting its envelope-based system for allocating funds to different categories and avoiding overspending.

Goodbudget will categorize your transactions as they come in and let you know how much money you have left in each category after you’ve spent the money. If the categories are too broad, they can be broken down into subcategories. This makes it easier to see where your money is going and where it’s coming from.

Since Goodbudget syncs across multiple phones, you don’t need to worry if you lose your phone or break it—your budget will sync up to your new phone (and the web!) through Goodbudget’s cloud servers. The passwords are encrypted when stored in the cloud, so no one can access your data unless they know your login information.

5. EveryDollar, Track Income, Bills & Savings

One of the best ways to keep your spending in check is to track it. I’ve been using EveryDollar to do that, and it has been a game changer for me. It’s so easy to use, and you can try it for free!

Here’s how it works:

- You input all of your income, so you know how much you have coming in each month.

- You input all of your bills, so you know when they are due and how much you need to pay.

- You input everything else you spend money on, so you can easily see where your money is going.

- Once you start tracking expenses, it will help motivate and inspire you to find ways to save more money than ever before!

The EveryDollar app makes it easy for you to track income, bills, and savings. It’s so helpful because you can get a complete picture of your financial situation in one place! You don’t have to jump from one website to another or use tedious spreadsheets any longer.

I used to struggle with managing my spending, until I started using this app. Now I can easily track my monthly income and expenses. I also have the option of setting up recurring bills that help me stay on top of my finances. This is especially important for me since I have a tendency of forgetting to pay things!

CNBC recommends Clarity Money as the best budget app for those looking to reduce unnecessary expenses and find ways to save, thanks to its bill negotiation feature and ability to suggest subscriptions to cancel.

You’ll love how easy it is to add transactions. They’re categorized automatically, so if you buy groceries at the store you don’t need to remember which category they fall under. If you buy something on Amazon, simply enter the amount and just tap “Amazon” and it will be added to the total spent online category for you. All of your expenses are totaled in just one click!

It’s easy to see how much money you have left over after paying all your bills too. It’s all right there in black and white, which helps me make better financial decisions that save money in the long run.

The app has a really cool feature that allows

6. Personal Capital, for tracking wealth and spending

Personal Capital: Personal Capital is an app that tracks wealth and spending. This app helps you stay on top of your budget and ensure you’re keeping up with all your financial goals. It also allows you to create a budget, track your investments, monitor cash flow, set savings goals, and more.

It provides detailed reports that let you know how much money you have coming in and going out so that you can make the best decisions with your money. We recommend this app as it offers excellent features, including retirement planning tools, investment analysis and tracking, integrated portfolio performance reporting, financial checkups & alerts, and access to advisors.

The pros are:

- Easy-to-use interface with helpful features.

- Extensive analytics and insights.

- Synchronization with banks.

- Ability to connect with multiple advisors.

- No account minimums or fees.

The Wall Street Journal recommends Personal Capital as a budget app for those with more complex financial portfolios, thanks to its ability to track investments and retirement savings alongside day-to-day spending.

However, one of the cons is that accounts and personal data stored in their servers may be exposed to hackers or other security threats.

7. Honeydue, for budgeting with a partner

Several apps help couples track their spending and income, but Honeydue is the only one that does it automatically. You set up your budget online, and then Honeydue pulls your transactions from your debit card and records them. It doesn’t just do this once a month, but every time you use your card.

A recent study found that couples who track their spending together are more likely to pay off their credit card balances every month—and that’s what Honeydue is all about: helping people achieve their financial goals together.

The app syncs with multiple budgets, so you can have one budget for groceries, another for entertainment—even a joint account for each of you to add money to (if you do this, make sure it’s easy to transfer money between the two of you).

Honeydue also has the option to plug in your income, so the app will tell you if you have enough money to spend according to your budget—which helps you stay on track.

Using the app is simple: when you go grocery shopping, snap a photo of your receipt and upload it online. You can even do this with paper receipts or online purchases; a scanner tool built into the app makes inputs easy.

Kiplinger’s Personal Finance suggests Honeydue as a budget app with a clean and intuitive design, noting its ability to track expenses and create customized budgets.

8. Fudget, for budgeting without syncing accounts

If you’re a budgeter, you have your way of doing things. Use inexpensive index cards to keep track of your spending or a more sophisticated spreadsheet on the computer. But what if you want to share your budget with a partner without having to share accounts?

What if you want a simple way for friends and family members to contribute to the household finances without getting access to all your information? Fudget is built for these purposes.

Fudget is an app that lets people track their spending, set budgets, and hold each other accountable. It’s super simple: there are no accounts, no confidential information, and everything is in plain sight.

No one except you can see how much money you have left in any category, but everyone can see how much money is left overall.

You can set up budgets with just a few taps and then communicate your progress to others with colored flags. Though the categories are preset (like groceries and utilities), they can be customized as needed—which means that someone contributing $200 per month as part of a household budget doesn’t have to feel like they are “just” paying the rent every time they use Fudget.

This manual is intended to assist you in developing a sustainable budget and to hold you responsible for your spending. These financial management applications can be helpful if you want to understand your cash flow or how much money you are coming in.